By agreeing to implement 59 cash ‘s products and services you're automatically agreeing to the plan said listed here. When you aren’t in agreement Together with the phrases of this coverage or presently are underneath the lawful age of eighteen (18) or not a US citizen then make sure you chorus from employing our products and services.

Experienced longevity annuity contracts supply tax rewards and the opportunity to delay necessary bare minimum distributions (RMDs) from the retirement accounts until finally an age specified in your annuity deal.

You may commonly cash out — or withdraw income from — most deferred annuities As long as you've not started acquiring payments from a single.

We preserve a firewall concerning our advertisers and our editorial workforce. Our editorial workforce doesn't get direct payment from our advertisers. Editorial Independence

Tapping your retirement price savings ought to only be utilised as a last resort. Here are some approaches to stay away from accessing your 401(k) or IRA early:

Our cookies also are employed to track in addition to concentrate on individuals with points they have an interest in which enhances their experience on our Web site. The cookies that are served i.e. persistent and session based are tied into the Personally Identifiable Details that we give you.

Retirement isn’t simply a location. It’s a journey, and we’re right here to help you. Our publication provides succinct and well timed guidelines, reviewed by Fiscal Advisors, that will help you navigate the path to economical independence.

fifty nine cash won't deliver financial loans and we do not have any say in the fees or phrases of our lenders. Our solutions are designed to consider your details and after that make it easy to discover the lender that will ideal provide your preferences.

fifty nine cash also fully reserves the right in order to disclose customer / member details in great faith in the event the regulation needs it.

That compares While using the seemingly infinite options offered on the open current market. As you attain age 59½ you might be qualified for an in-service rollover, which allows you to go 401(k) resources into an IRA without having penalty even although you still work for the same employer.

Furthermore, Annuity.org operates independently of its associates and has read more complete editorial control about the knowledge we publish.

Spee utilizes immediate generate off approach for lousy debts. No undesirable debts ended up recorded in The present 12 months. Under the cash foundation of accounting, what volume of gross sales earnings should Spee report for The existing 12 months?

This may be described by an idea known as the time price of money, which states that a dollar in hand now's truly worth over a greenback in hand afterwards because of its fascination-earning opportunity.

However, you could qualify for a unique exemption based upon The principles and laws for IRAs. Speak to your tax advisor to find which exemptions utilize towards your problem.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Judge Reinhold Then & Now!

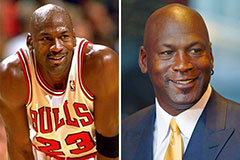

Judge Reinhold Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!